Contact Us

If you’re seeking ways to invest in leadership teams or require the expertise, guidance and support of a strategic-led implementation partner, then contact us today and a member of our team will be in touch soon.

September 22nd, 2022

Reflecting on the year to date and looking ahead to 2023, what has been going on across the consumer market and what can we expect looking ahead?

We hear from leading industry experts;

Liam McGuinness, Partner at CIL Management Consultants

Shaun Browne, Co-Head Consumer, Food & Retail Europe and Co-Head Corporate Finance, Europe at Houlihan Lokey

Dan Martinez Partner at Liberty Corporate Finance

Mark Sherman Managing Director, Consumer Practice at DRAX

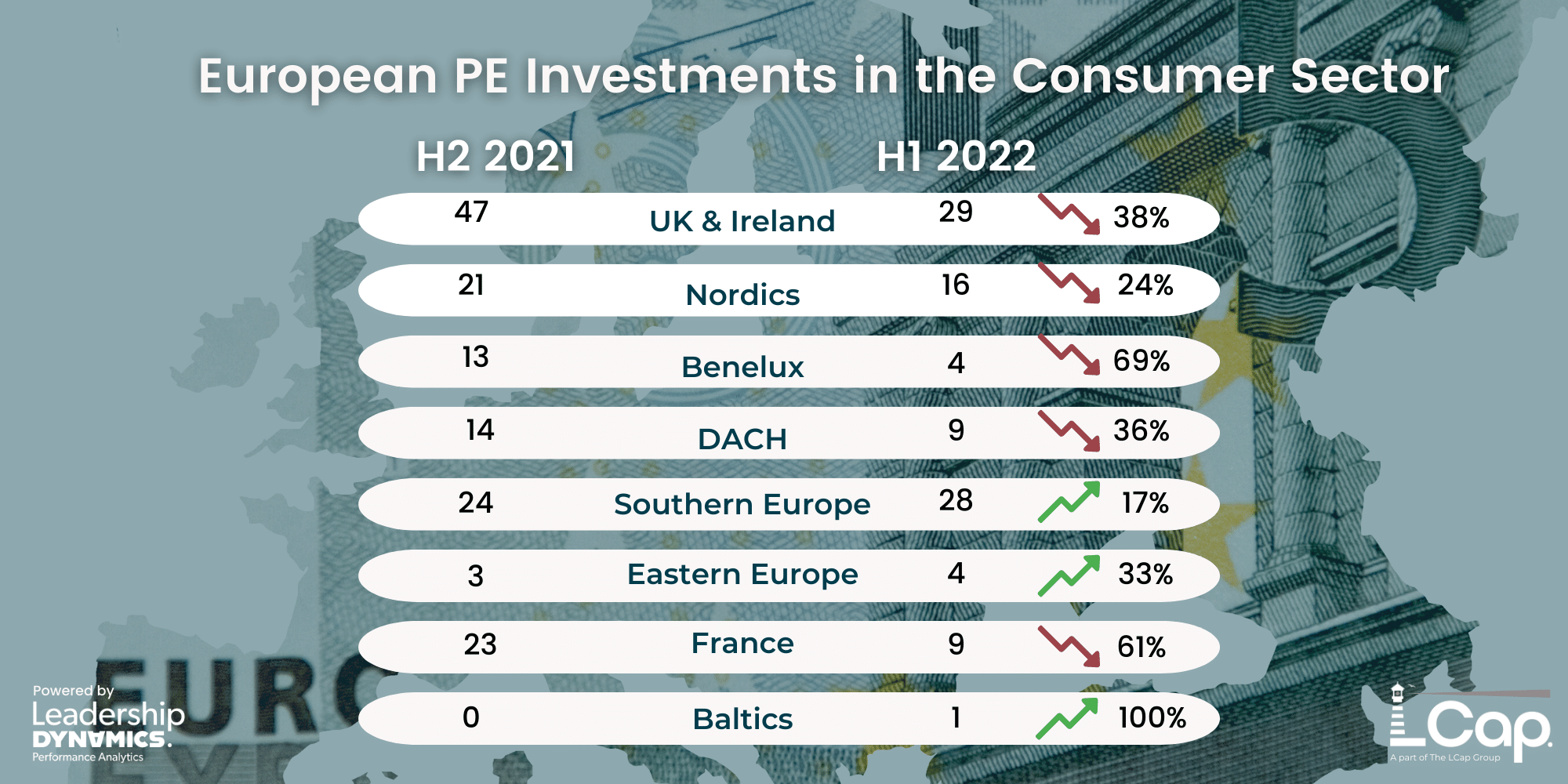

European PE Investments in the Consumer Sector

Overall, the investment and exit data in the consumer sector reflects a significant downward trend, particularly in key regions such as the UK, France, Germany and Benelux in H1 2022. We expect this trend to continue particularly as financing deals have become more challenging, especially with the current economic headwinds. There have been 100 investments in H1 2022 where a cheque of £5m+ has been deployed across the European market, compared to 145 in H2 2022.

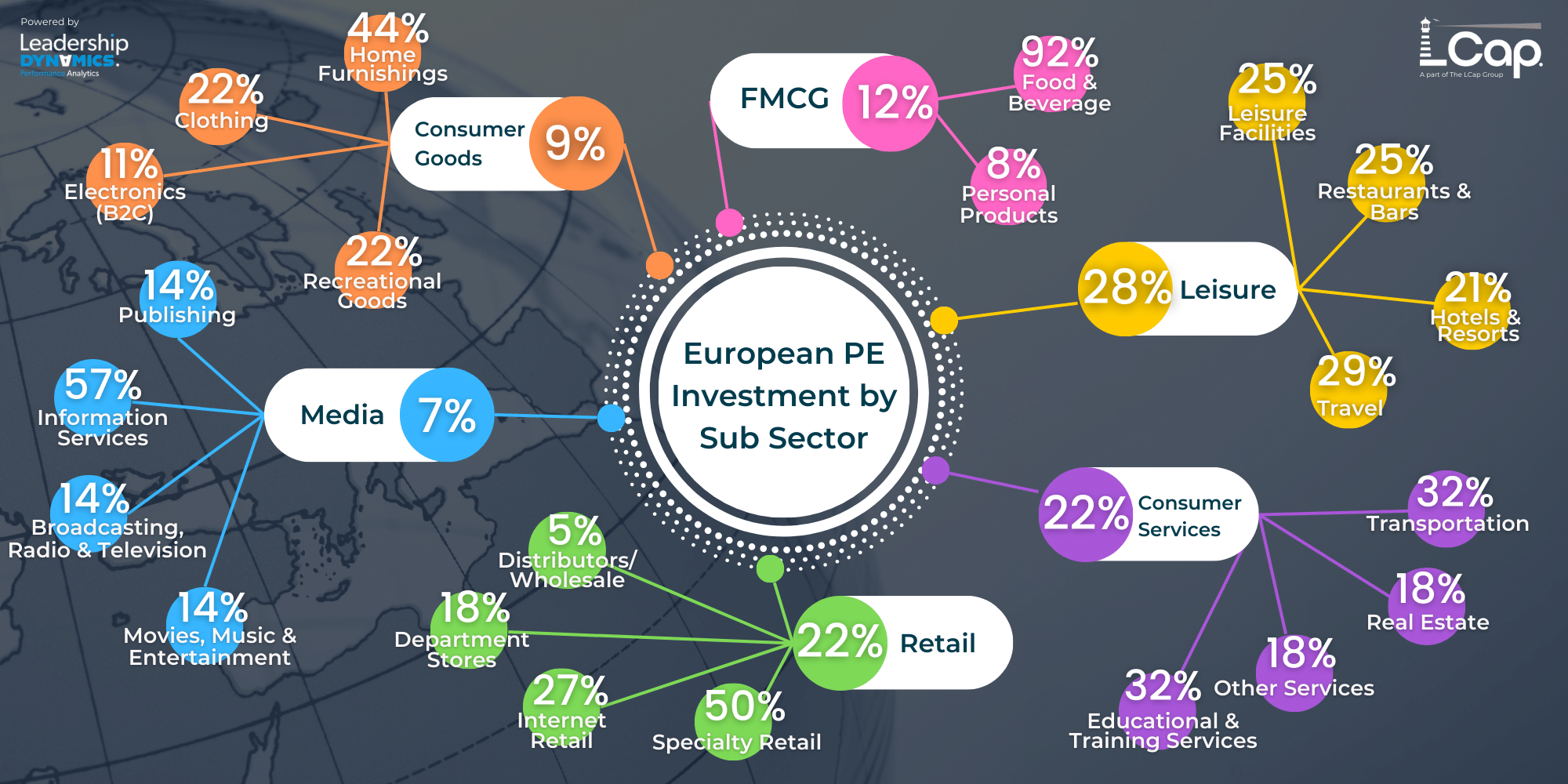

However, given the slowdown of the market in the last few months, this gap is expected to widen when considering investments in H2 2022. The most significant sector invested in has been the leisure sector, and this is a trend we predict will continue into the latter part of 2022. Despite the impact caused by COVID-19, the travel sector will be viewed as a resilient place to deploy capital moving forward, particularly domestic travel.

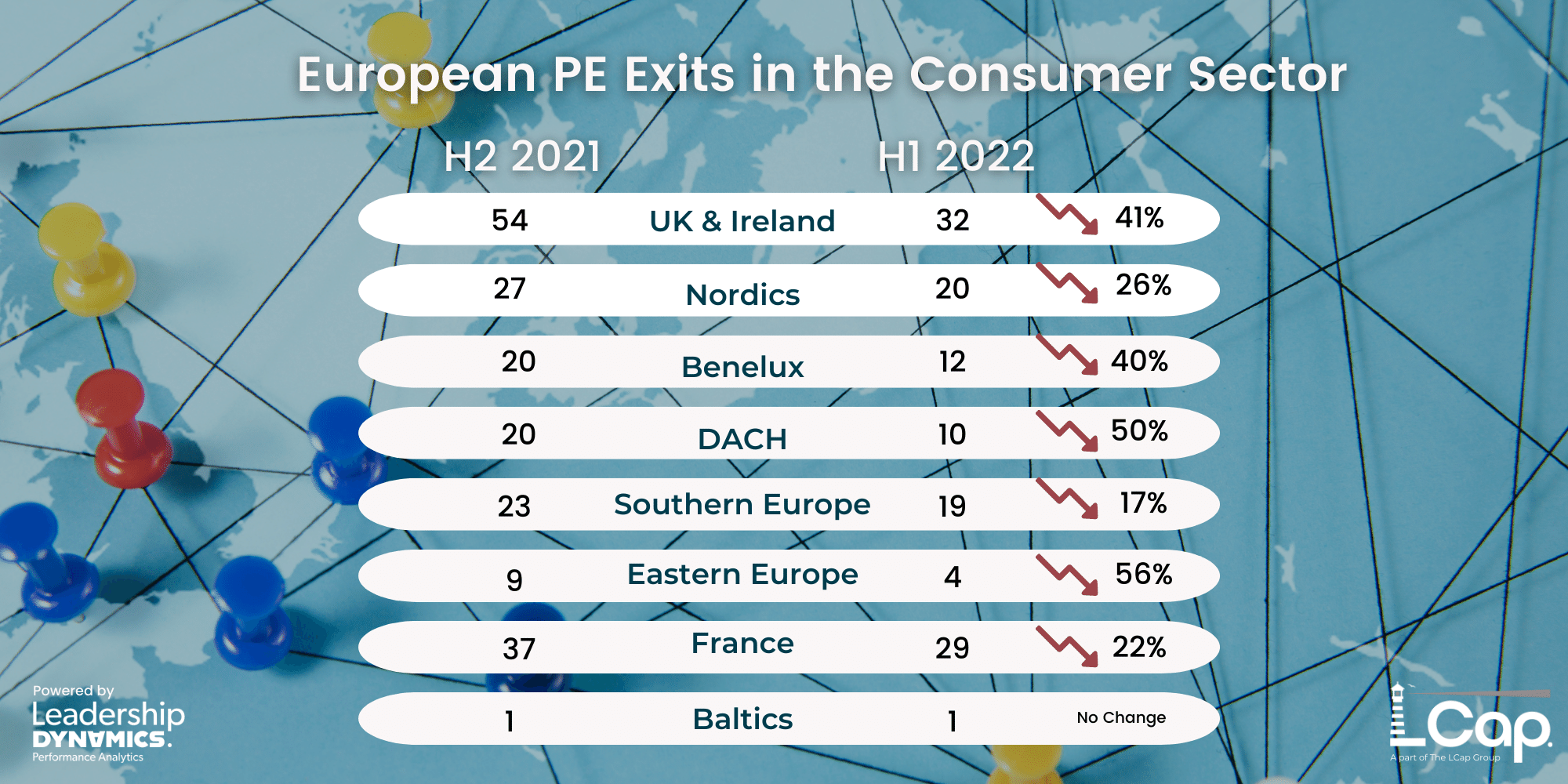

European PE Exits in the Consumer Sector

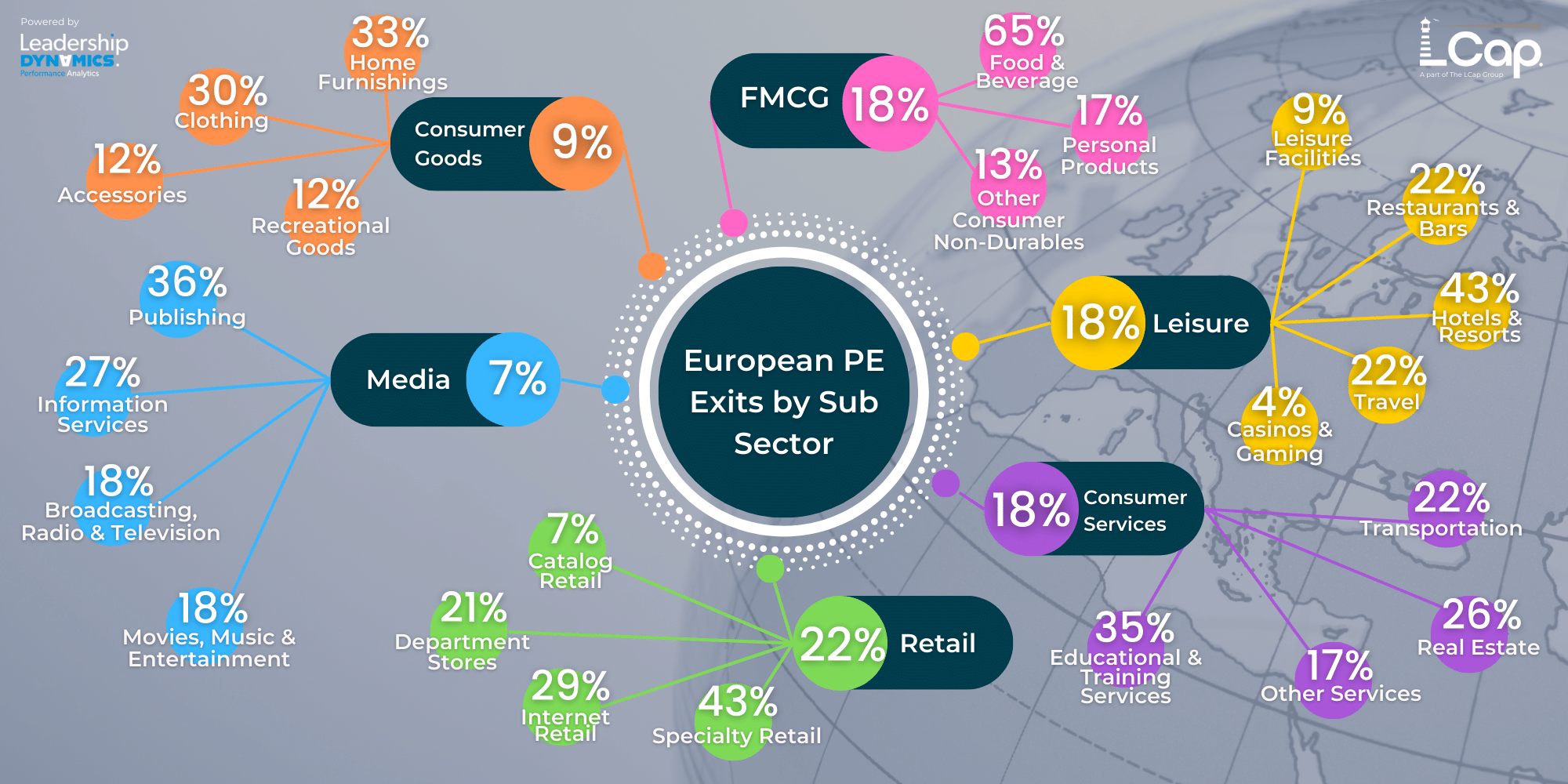

There have been 127 consumer exits in H1 2022 which is also down when compared to the 191 that occurred in H2 2021. There is also a notable uptick in exits across the leisure sector, particularly restaurants and travel. Our deal “pipeline” suggests there will be more businesses coming to market in this space, but the question remains as to whether areas like restaurants will be attractive given the past performance in this sub sector. The exit market is likely to be limited with momentum regained into 2023.

The current climate suggests that private equity investors will focus on highly resilient sectors such as experiences, gifting, non-discretionary consumer products and the value end of FMCG.

If you’re seeking ways to invest in leadership teams or require the expertise, guidance and support of a strategic-led implementation partner, then contact us today and a member of our team will be in touch soon.

Apply now and a member of our team will be in touch shortly.