Contact Us

If you’re seeking ways to invest in leadership teams or require the expertise, guidance and support of a strategic-led implementation partner, then contact us today and a member of our team will be in touch soon.

September 9th, 2025

The first half of 2025 has been a turbulent and revealing period in private equity. The same headline themes have continued to dominate: continuation funds, GP-led secondaries, and fundraising pressures. However, beneath these, the market is shifting in ways that have direct consequences for both capital flows and human capital.

Private equity continues to outperform over the long term; however, the short-term picture is less favourable. According to Preqin, constrained exits have weighed on recent returns even as the asset class remains the strongest performer against public benchmarks. Venture capital firms were surprised by the positive Q1 figures, though caution is warranted given the potential for further valuation resets. Infrastructure has offered rare stability, delivering 9.2% one-year returns to March 2025, while private debt remains the most consistent story, with three-year returns of 24.2% and steady outperformance of public debt markets.

Deal activity has recovered in terms of value. McKinsey’s analysis shows global deal value rose 14% in 2024, led by transactions above $500 million and a resurgence of public-to-private activity in Europe. Bain points to a similar 37% rebound, coupled with exits up 34%. The problem is liquidity. Fundraising fell another 23–24%, marking the third consecutive annual decline, and the backlog of unrealised assets, now $3.6 trillion globally, remains the biggest drag on LP sentiment.

Europe’s picture is equally mixed. PitchBook data shows Q2 deal value fell 10.5% quarter-on-quarter, hit by tariff shocks, even as deal count grew 3.1% as activity picked up in June. Add-ons dominated, accounting for half of all transactions, while healthcare surged by 40% year-on-year and industrials slowed materially. Exits remained muted, with sponsor-to-sponsor deals taking the lion’s share and IPOs all but absent.

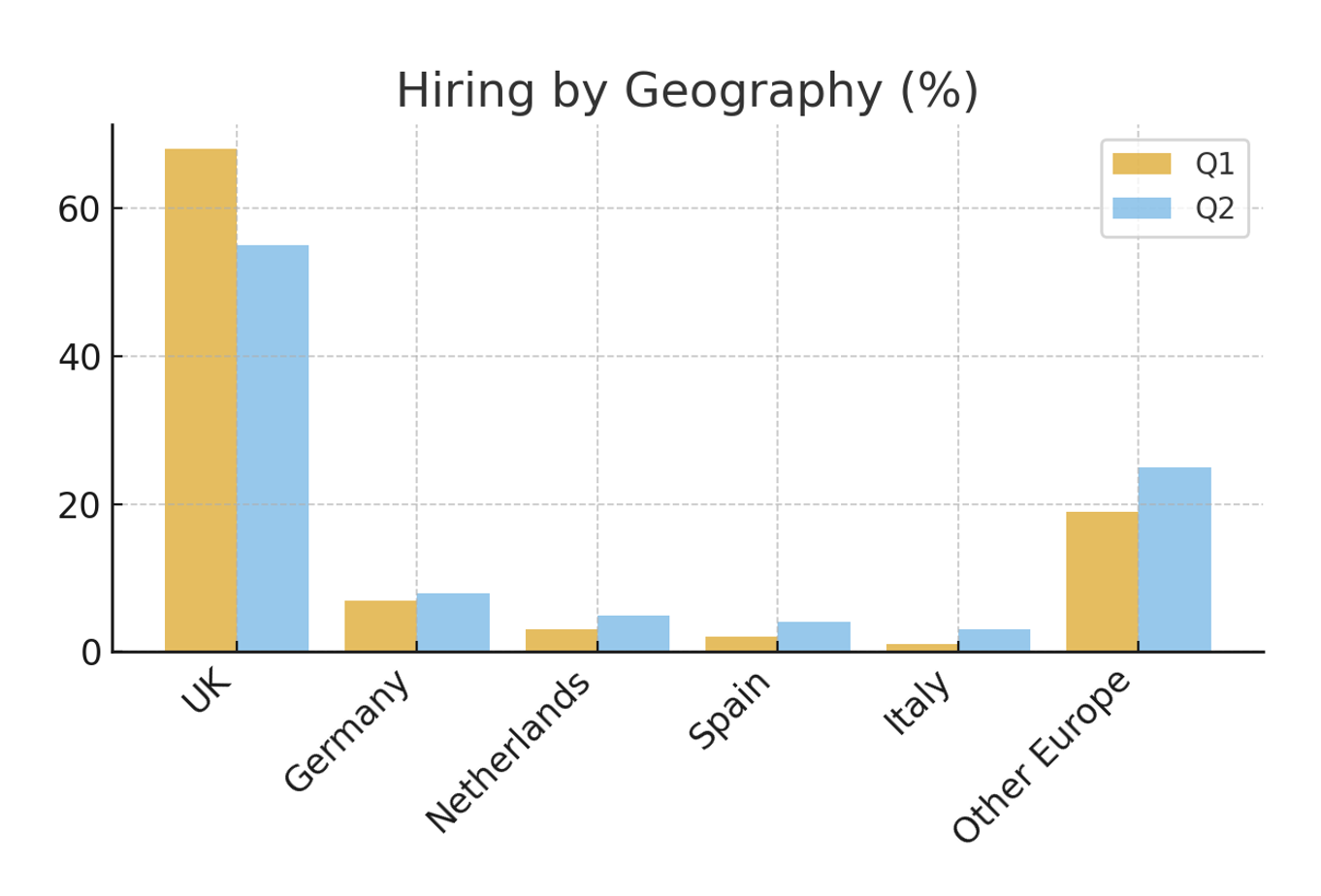

The hiring landscape mirrored these dynamics. After a strong Q1, Q2 saw a sharp deceleration, with 272 hires in the first quarter declining to 191 in the second, representing a 30% decrease. The UK still led but its dominance eased, dropping from 68% of hires in Q1 to 55% in Q2, as Germany, the Netherlands, Spain and Italy gained ground. The market is becoming more geographically balanced, though London remains the hub.

Data Source: Drax Altus tracked market moves – H1 2025

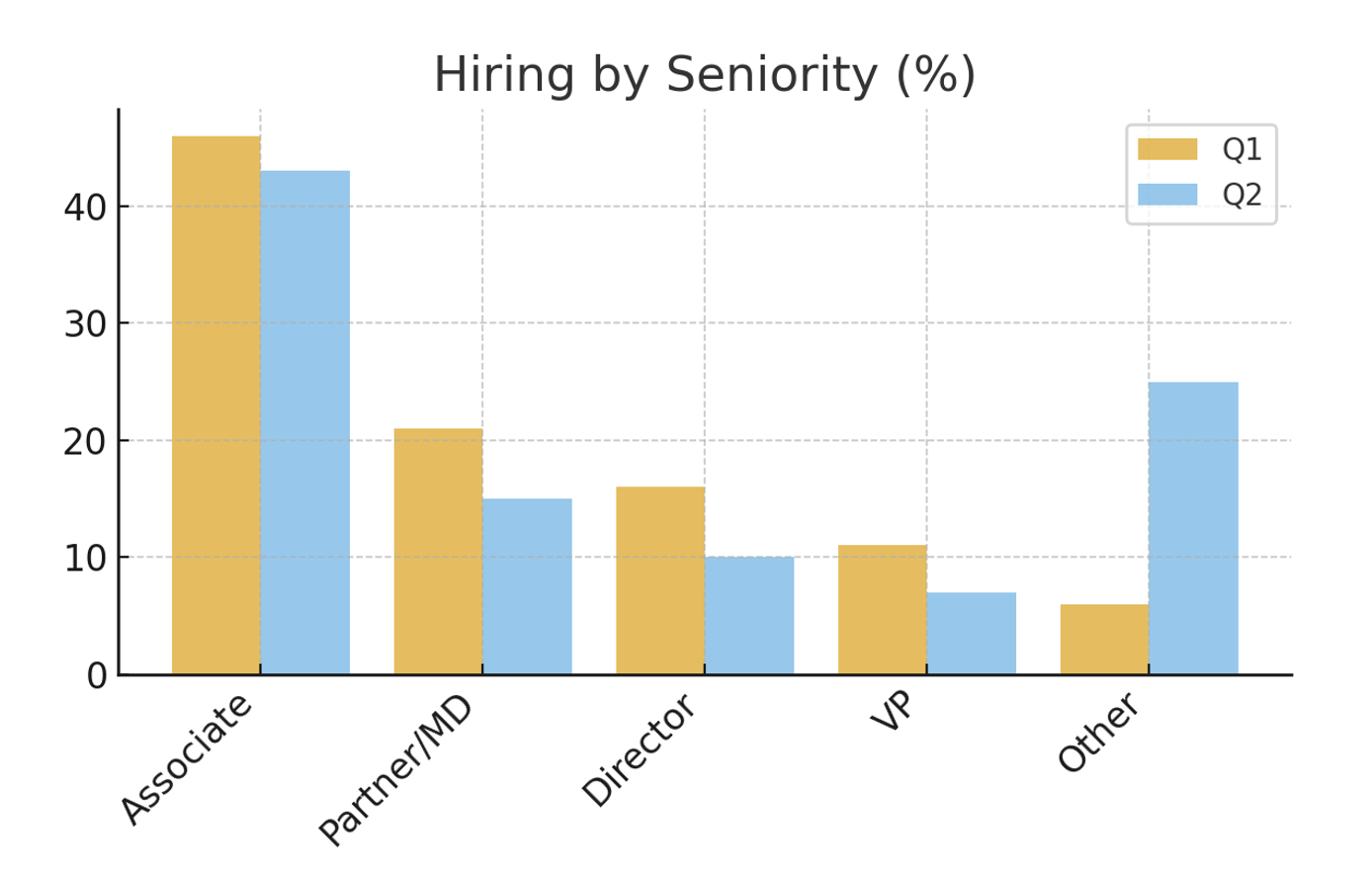

Seniority tells a clear story. Associate hiring remained the primary driver, decreasing slightly from 46% in Q1 to 43% in Q2, while Partner and MD hires decreased from 21% to 15%. Director and VP appointments were also contracted.

Data Source: Drax Altus tracked market moves – H1 2025

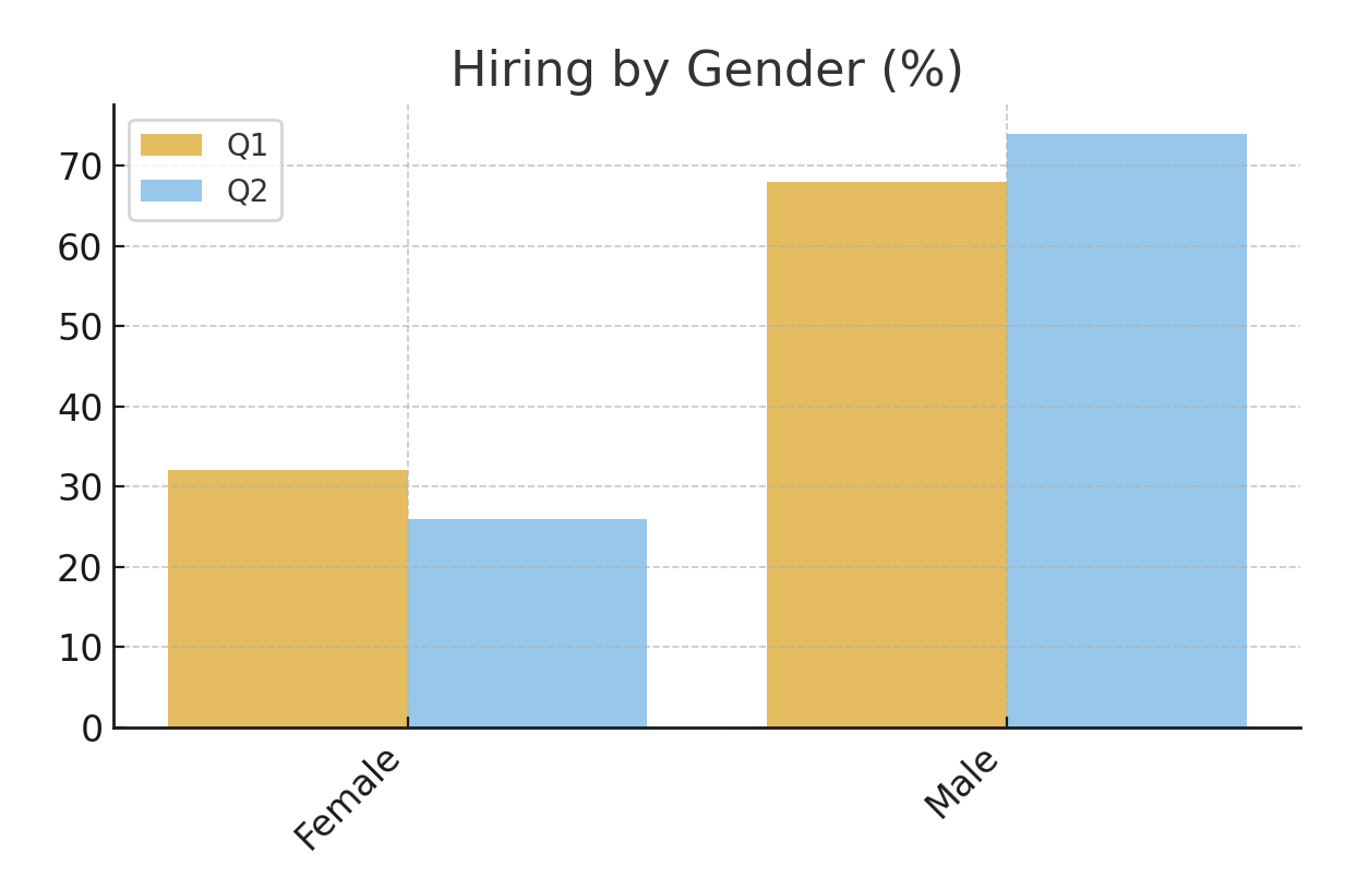

Diversity progress remains uneven. Female representation slipped overall from 32% in Q1 to 26% in Q2, though Large Cap firms bucked the trend with 58% female hires. By contrast, debt and infrastructure strategies remain underrepresented by females, with fewer than 20% female representation.

Data Source: Drax Altus tracked market moves – H1 2025

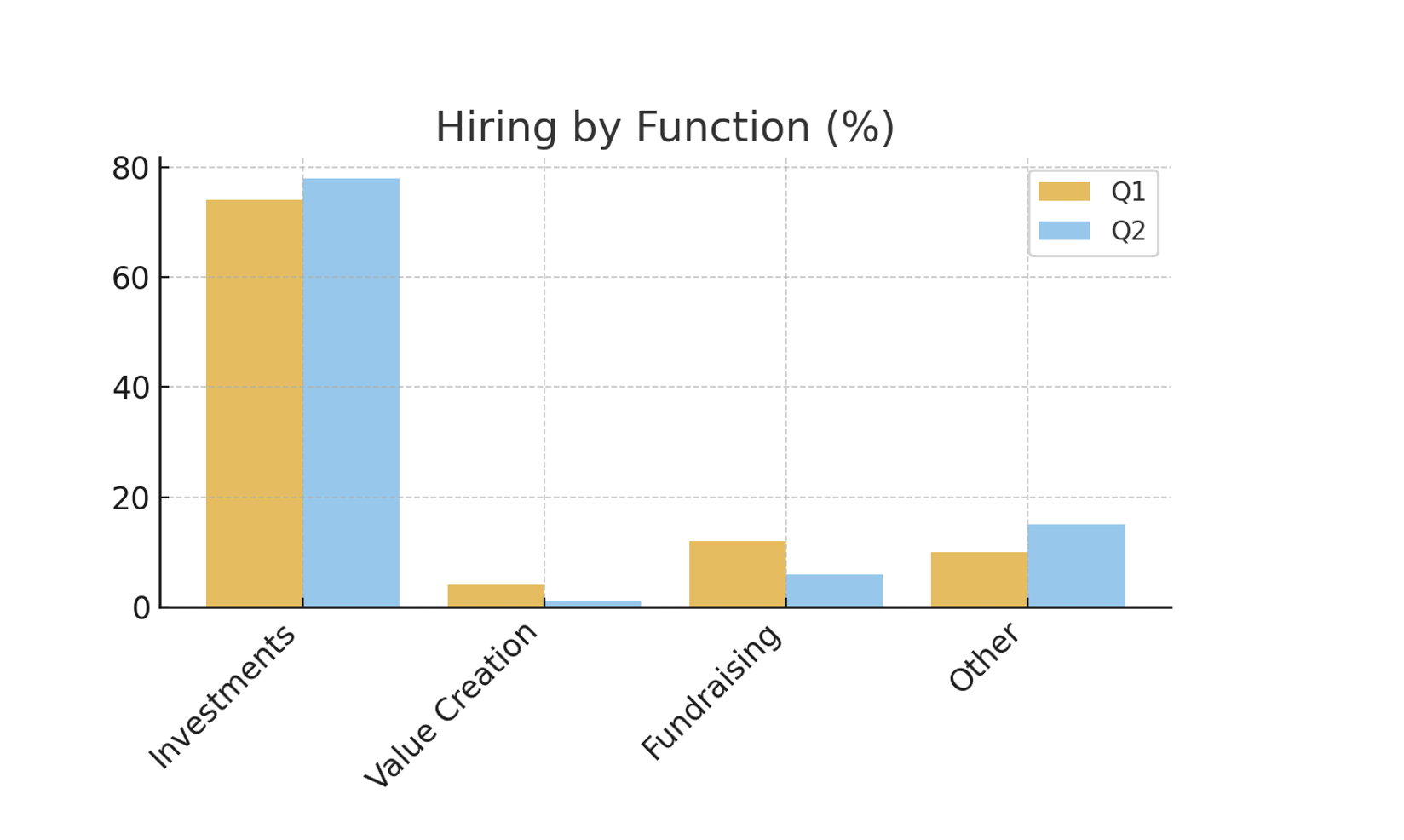

Functionally, investment hires dominated even more heavily, rising from 74% to 78% of the total. Value creation and fundraising roles slowed, with value creation falling below 1% and fundraising down to 6%. Hiring for finance, legal, ESG, and operations was negligible.

Data Source: Drax Altus tracked market moves – H1 2025

By strategy, Growth equity and Large Cap funds led activity, while Mid-Market hiring halved and venture hiring almost disappeared. Infrastructure held steady at around 10%.

The backgrounds of hires underline this selectivity. Private markets experience accounted for the majority of Q2 hires. Investment banking experience also surged. Consulting, industry and legal backgrounds have reduced considerably. The preference for candidates with directly relevant experience is overwhelming.

Tenure is shortening, too. The average time at a prior employer fell from 4.05 years in Q1 to 3.15 years in Q2, suggesting that funds are increasingly hiring earlier-stage professionals with shorter track records.

The rules of the game are shifting once again. Liquidity is the premium currency for LPs, and firms are responding by concentrating their hiring efforts at the sharp end of deal execution. For professionals, this means experience in private markets and banking is now essential. For firms, it means the long-term capability build, operating partners, fundraising talent, and broader portfolio functions are being deferred in favour of immediate investment firepower.

The second half of 2025 will show whether this short-term bias holds. With financing costs easing and public-to-private activity rising, larger deals may provide more confidence. It looks to be an interesting run to the end of the year!

Who We Are – DRAX Altus

Born as Altus Partners in 2009, our firm built its reputation by placing exceptional leaders across investment, finance, and portfolio operations for leading private equity and credit funds. In 2023, we joined DRAX Executive and The LCap Group, combining boutique precision with the reach and data-rich capability of a global leadership platform.

Today, DRAX Altus is the specialist fund-search practice of The LCap Group. We build investment, fundraising, and leadership teams for GPs and LPs worldwide, leveraging behavioural analytics and leadership data to deliver diverse, high-impact talent.

Our difference lies in going beyond search. We benchmark leadership behaviours, diagnose team effectiveness, and design succession pathways, enabling funds to maximise value creation across their portfolios. Whether it’s Chair placement, board build-outs, or executive leadership transitions, we support every stage of the private markets leadership journey.

Talk to us

If you’re looking to strengthen your leadership team or gain deeper insight into the behaviours that drive performance, get in touch with the DRAX Altus team.

About The LCap Group

DRAX Altus is part of The LCap Group, the global tech-enabled leadership advisory group. LCap brings together specialist brands: DRAX, Peoplewise, and Confidas People, to deliver integrated solutions across Talent, Risk, and Development.

Through its unique combination of services, products, and platforms, LCap provides a 360° approach to leadership:

Risk – delivered by Confidas People, covering risk, intelligence, and diligence.

Talent – led by DRAX, providing executive change, deal advisory, and leadership advisory.

Development – driven by Peoplewise, specialising in assessment, development, and performance.

LCap’s proprietary tools enable clients to measure behaviours, assess resilience, and benchmark leadership capabilities with unrivalled precision.

Together, the group equips organisations with the insight, talent, and leadership needed to succeed in complex and fast-changing markets.

If you’re seeking ways to invest in leadership teams or require the expertise, guidance and support of a strategic-led implementation partner, then contact us today and a member of our team will be in touch soon.

Apply now and a member of our team will be in touch shortly.