Contact Us

If you’re seeking ways to invest in leadership teams or require the expertise, guidance and support of a strategic-led implementation partner, then contact us today and a member of our team will be in touch soon.

July 4th, 2025

The right CRO can be the difference between growth and stagnation in private equity-backed businesses, especially in the current market. Yet, companies often overlook the importance of aligning a CRO’s competencies and behaviours with the business growth stage and revenue challenge. What should they be looking for?

As the M&A slowdown persists, top-level CROs are in high demand. Where deals are happening, investors must be ready to capitalise as quickly as possible. And where they aren’t, solid organic growth is needed to turn around struggling assets and hit value creation targets in a pressurised timeframe. In both cases, success is only possible with a go-to-market leader who knows the right strings to pull.

CROs are skilled at funnelling resources towards winning the right customers cost-effectively. But their critical role in orchestrating growth means they are also expensive to get wrong. CROs aren’t one-size-fits-all. The right behaviours and competencies for one business can be entirely wrong for another. Over-indexing on experience vs behavioural fit, or sector over situational experience, can mean stagnating growth, or a company failing to reach its full potential.

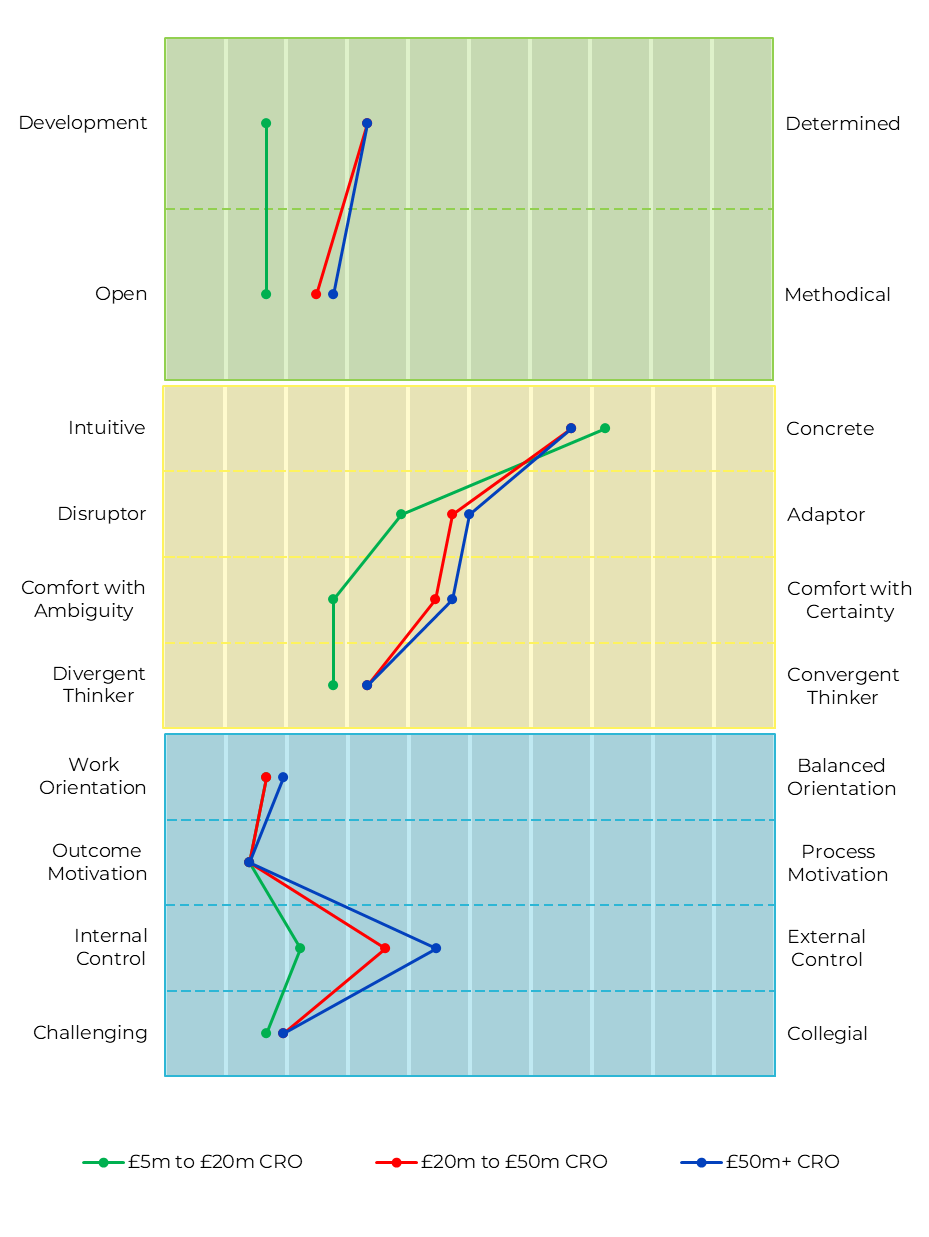

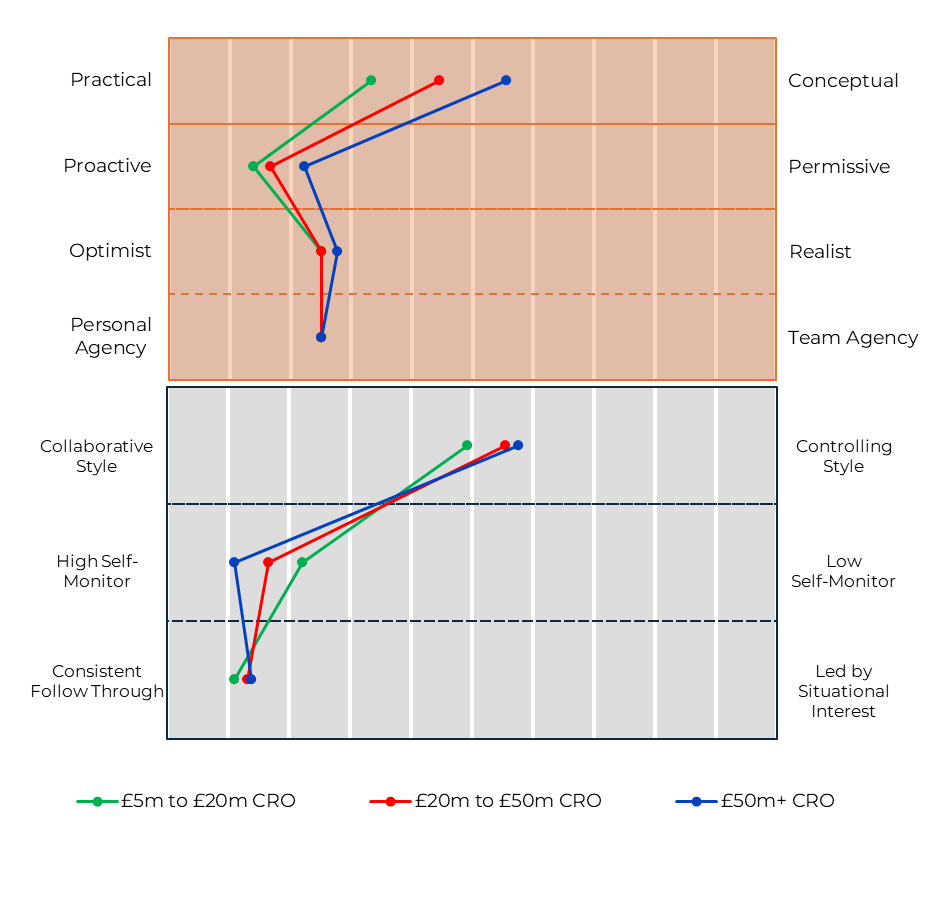

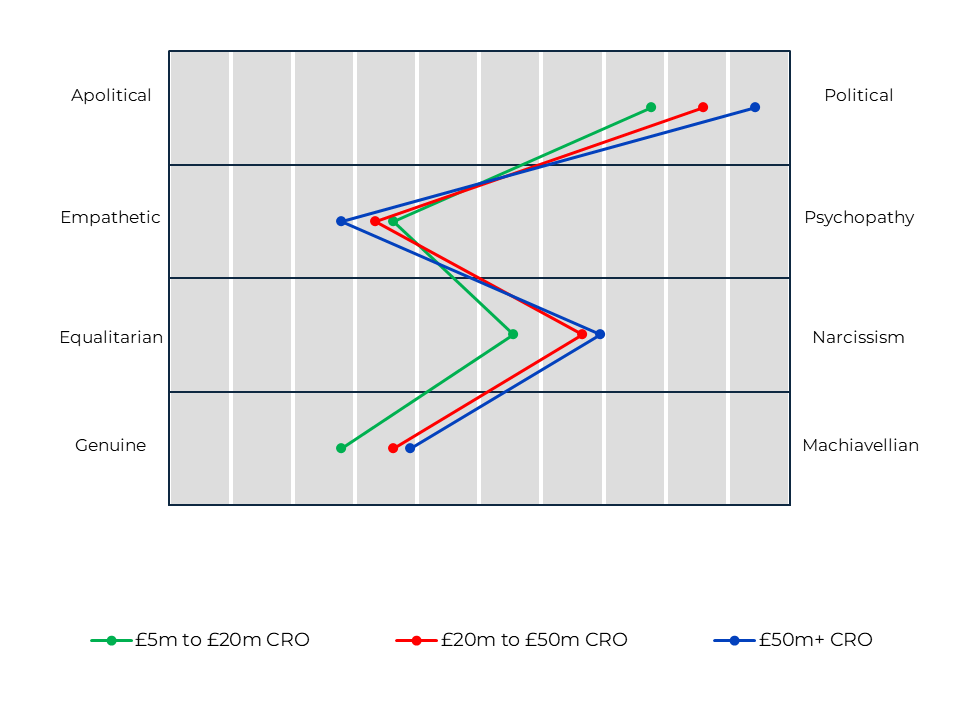

At Drax, we’ve seen the whole spectrum of CRO appointments, from growth companies hiring their first CRO to large-cap firms looking for a global revenue leader. By using our behavioural evaluation, PACE (Pragmatism, Agility, Curiosity and Execution), and our data-driven leadership performance platforms, Leadership Dynamics, we’ve mapped the full breadth of CRO competencies and behaviours. This is our playbook for success.

Size matters

While not the only factor to consider, business size by revenue is a good place to start when assessing CRO fit, because the nature of the role evolves so dramatically as a business grows. The CRO behavioural and competency profile can look quite different across £5m, £20m, and £50m+ businesses.

£5m to £20m

Probably hiring its first CRO, a business of this size is invariably looking to bring a strategic view to complement a head of sales, a marketing lead, or to free up a technically focused founder. Without the process and resources of a larger company, a CRO must simultaneously know what good looks like and be comfortable with being hands-on. As a result, a balance of career experience across large corporate-style businesses and at the growth stage is advantageous.

Through the lens of PACE, that translates into a behavioural profile that brings strong personal convictions with low ego, an executional focus which bleeds accountability down through the organisation, and high levels of agility, showcasing a growth mindset. High comfort with ambiguity also enables these leaders to pivot and adapt to rapid market and organisational shifts as well as evolving customer profiles (ICP).

Scaling from £20m to £50m

With a more sophisticated go-to-market function established, focus shifts to expanding revenue opportunities, whether launching new product lines, entering new geographies, pursuing M&A, or optimising existing revenue streams. This demands a more specific situational profile to match a more defined growth strategy, along with behaviours that align with new expectations.

For example, political and influencing skills rise up the agenda, as organisational complexity increases. At the same time, a more analytical, strategic approach will enable a CRO to identify and exploit new opportunities, while a more challenging and directive mindset enables them to maintain focus and handle potential conflict effectively. Pragmatism remains important to drive growth, however, execution and agility may be deprioritised as strong sales management is instilled, freeing the CRO to focus on strategic opportunities.

£50m+

Once a business hits £50m, it knows what it does well, and the CRO’s role is to adapt and optimise what works, rather than reinventing the wheel. At this stage, the PACE profile should therefore lean more towards adaptation rather than disruption, and collaboration rather than control, enabling a CRO to hold a steady course and manage a larger group of stakeholders. The dark triad becomes more important again, particularly narcissism, to ensure a CRO can defend their views in a high-stakes environment when challenged by internal and external stakeholders.

Size isn’t everything

But, business size isn’t the only factor influencing CRO fit; the nature of the sales cycle and revenue generation are also critical. We often see businesses make the mistake of hiring for domain experience and customer knowledge, without considering the sales cycle and GTM strategy alongside that. As customer and domain knowledge are likely to be strong within the existing team, plugging the situational gap around scaling, and bringing in the right behaviours should be prioritised.

Designing and managing an effective GTM strategy for a high volume, low value business requires a different approach than one where deal value values are regularly 10x that of SMB and sales cycles are more complex. With the former, a repeatable, consistent process is key, along with a keen eye for KPIs. So, when assessing the behavioural indicators in our PACE framework, we often advise indexing on candidates who favour the concrete over intuition, internal control over external control, and who have a high propensity to follow through.

In contrast, an enterprise sell would suit a CRO with high levels of agility, outcome motivation and openness to try new approaches when handling a more fluid sales cycle.

Team dynamics

The final piece of the puzzle is considering the nature of the team a CRO will join, assessing its functional roles, skills, competencies, and behaviours. For example, will a CRO work alongside a Chief Commercial Officer (CCO) and/or Chief Marketing Officer? If it’s a founder-led business, what is the profile of the founding team? And how does the size of the business impact team dynamics?

Considering all these factors together helps investors and leadership teams laser in on the right CRO, who will fulfil the needs of the business both now and as it moves to the next level.

Specialising in placing PE-backed leadership talent, Drax plays an invaluable role in this process. By drawing on data and experience, we can pinpoint exactly what has worked in businesses like yours, the leadership profile that will deliver the greatest impact, and a final CRO candidate who is guaranteed to deliver.

The CRO doesn’t work in a silo; the leaders and team around them are equally critical to success. To explore team dynamics in more detail, my next article will unpack the Chief Commercial Officer role, what an ideal profile looks like for different types of businesses, and their relationship with the CRO and other commercial team members.

If any of the themes in this article resonate with you and you would like to discuss them further please get in touch. You can email Adam here.

If you’re seeking ways to invest in leadership teams or require the expertise, guidance and support of a strategic-led implementation partner, then contact us today and a member of our team will be in touch soon.

Apply now and a member of our team will be in touch shortly.